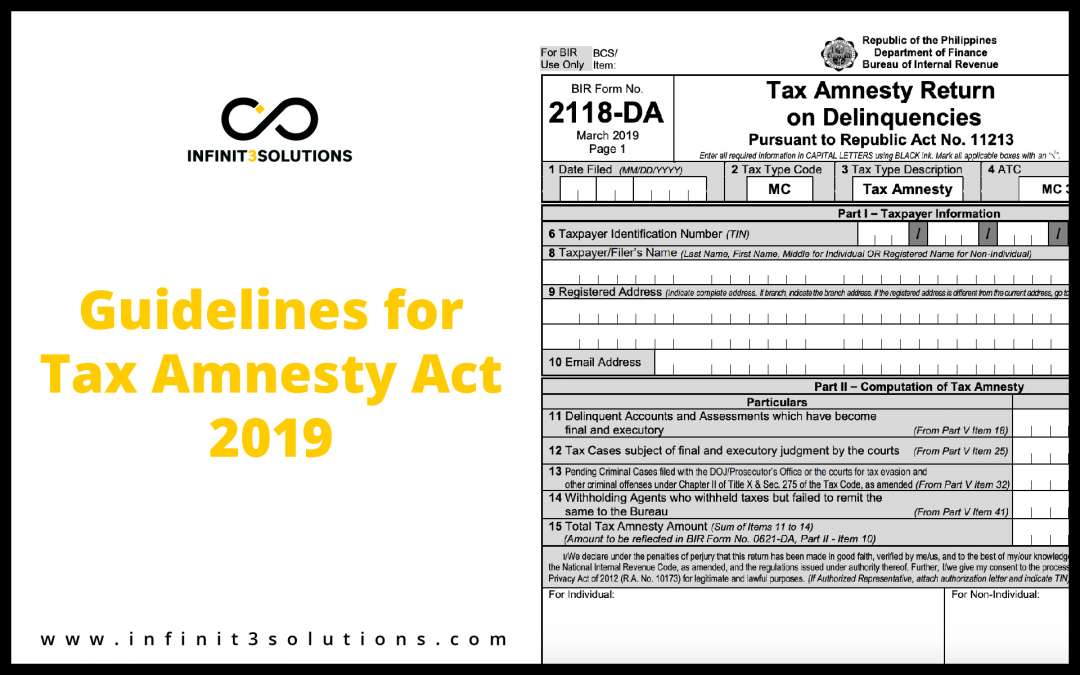

Good news for individuals and companies who have delinquent accounts with BIR! The Bureau of Internal Revenue (BIR) issued a Revenue Regulations No. 4-2019 (RR 4-2019) last April 5, 2019. This RR 4-2019 is the Implementing Rules and Regulations of Republic Act No. 71213, Otherwise Known as the “Tax Amnesty Act”, providing the Guidelines on the processing of Tax Amnesty Application on Tax Delinquencies.

A Delinquent Account shall pertain to a tax due from a taxpayer arising from the audit of the Bureau of Internal Revenue (BIR) which had been issued Assessment Notices that have become final and executory.

Who can avail?

All persons whether natural or juridical, with internal revenue tax liabilities covering the taxable year 2017 and prior years, may avail the tax amnesty within in one (1) year from the effectivity of the RR (beginning April 24, 2019)

Taxpayers who avail of the amnesty, “upon full compliance with all the conditions set forth hereof, shall be considered settled, and the criminal case in connection therewith and it’s the corresponding civil or administrative case, if applicable, shall be terminated,” RR 4-2019 read.

What are the inclusions?

- Delinquent Accounts as of the effectivity of these R.egulations, including the following:

-

- Delinquent Accounts with application for compromise settlement either on the basis of (a) doubtful validity of the assessment or (b) financial incapacity of the taxpayer, whether the same was denied by or still pending with the Regional Evaluation Board (REB) or the National Evaluation Board (REB), as the case may be, on or before the effectivity of these Regulations;

- Delinquent Withholding Tax liabilities arising from non-withholding tax; and

- Delinquent Estate tax liabilities.

-

- With pending criminal cases with the DOJ/Prosecutor’s Office or the courts for tax evasion and other criminal offenses under Chapter II of Title X and Section 275 of the Tax Code, as amended, with or without assessments duly issued;

- With final and executory judgment by the courts on or before the effectivity of these Regulations; and

- Withholding tax liabilities of withholding agents arising from their failure to remit withheld taxes.

Tax Amnesty Rates:

| NATURE OF DELINQUENCY | TAX AMNESTY RATE |

| Delinquencies and assessments which have become final & executory 40% | 40% |

| Tax Cases subject of final and executory judgment by the courts | 50% |

| Pending criminal cases with a criminal information filed with the Department of Justice or the courts for tax evasion and other criminal offenses under Chapter II, Title X and Section 275 of the Tax Code | 60% |

| Withholding agents who withhold taxes but failed to remit the same to the BIR | 100% |

What are the requirements?

- 1. Tax Amnesty Return (TAR) (BIR Form No.2118-DA, Annex “A”), completely and accurately accomplished and made under oath;

- 2. Acceptance Payment Form (APF) (BIR Form No. 0621-DA, Annex “B”) duly validated by the Authorized Agent Banks (AABs) or APF duly stamped “received” with accompanying bank deposit slip duly validated by the concerned AABs or Revenue Official Receipt (ROR) issued by the Revenue Collection Officers (RCOs);

- 3. Certificate of Tax Delinquencies/Tax Liabilities issued by concerned BIR offices (Annex “c”); and

- 4. In case of applications under Section 3(AX2) of these Regulations, a copy of the assessment found in the FANIFDDA: Provided that, in cases of applications under Section 3(D), either delinquent account or not, with or r.vithout FAN/FDDA, the Preliminary Assessment Notice (PAN)A{otice for Informal Conference or equivalent document is sufficient.

Steps on how to avail Tax Amnesty:

- Secure Certificate of Delinquencies/Tax Liabilities.

- Present all documentary requirements for endorsement of the Acceptance Payment Form (APF).

- Pay the tax amnesty at the Authorized Agent Banks (AABs).

- File all requirements including proof of payment.

- Receive the notice of issuance of authority to cancel the assessment (NIATCA) it shall be issued by the BIR within 15 calendar days. This shall then be considered sufficient proof of availing the tax amnesty.

It’s always better to check with the Officer of the Day at your respective BIR offices to thoroughly check if you or your business is eligible for the said Tax Amnesty.

For those who need further clarification, or in need of assistance, contact us and we’ll be glad to assist.

Reference: