After the registration process for new businesses in the Bureau of Internal Revenue (BIR), there is still various tax deadline that business owners need to keep a tab on. With the implementation of the TRAIN Law a year ago, there have been some confusions about the deadlines and which type of forms to submit. Today, we will discuss the tax forms that you need to submit if your business falls under the category of Corporation with Percentage Tax or for those companies who earn less than Php 3 million annually.

For starters, you can identify what taxes you need to file in your Certificate of Registration or what we call COR. The common taxes for Corporations are Expanded Withholding Tax, Percentage Tax, Withholding Compensation, Income Tax, etc. If there has been a mistake on which type of taxes you need to file that was stated in your COR, you need to inform your respective Revenue District Office (RDO) and submit Form 1905 (Application for Registration Information Update/Correction/Cancellation).

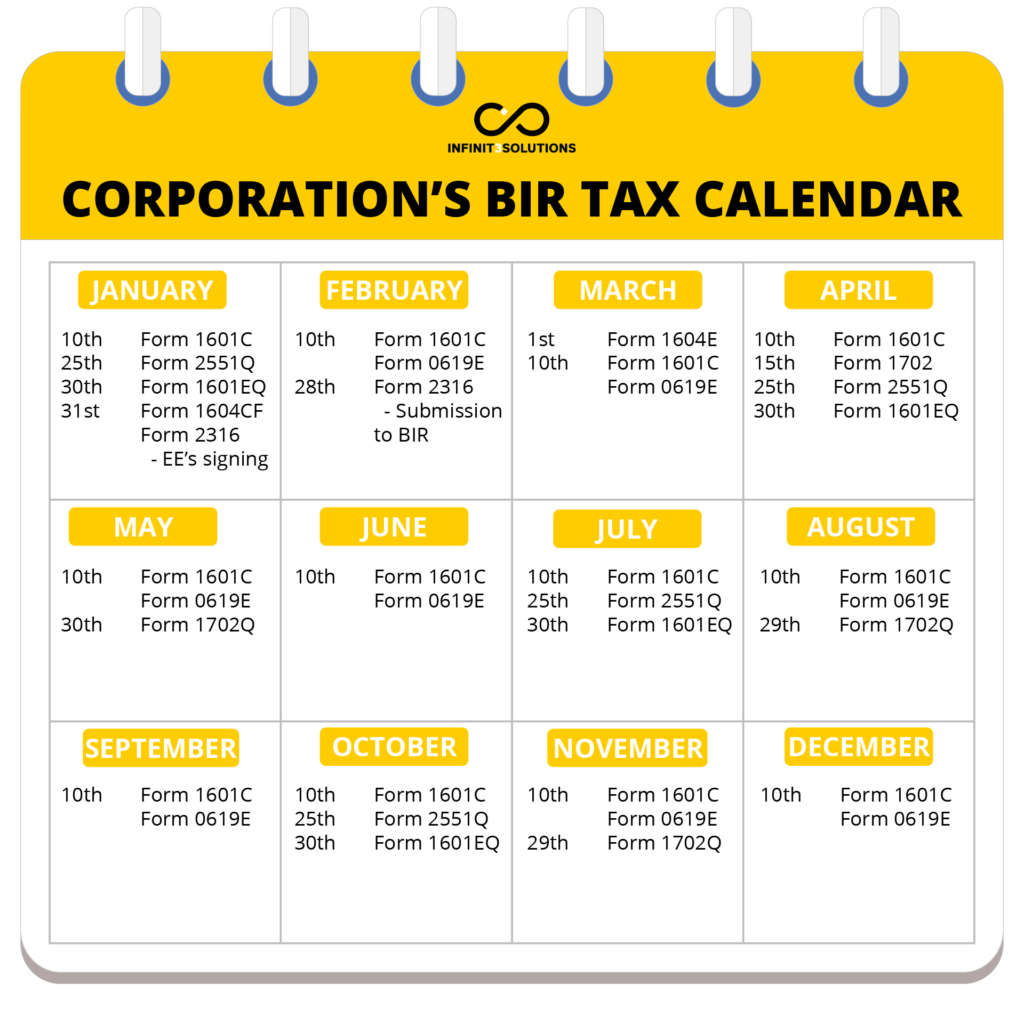

If you’re new to the business or just opened your corporation and planning to handle all your bookkeeping and tax compliance here is a BIR Tax calendar guide that will help you about what form to submit and their due date.

WITHHOLDING COMPENSATION

Monthly Remittance Return of Income Taxes Withheld on Compensation

Form: 1601C

It is the income tax liability of the employee which needs to be deducted and submitted by the employer to BIR. The deadline is on every 10th day of the month. Take note that, even if the employee is not liable for any taxes, the employer still needs to submit this form monthly with zero as the total.

Annual Information Return of Income Tax Withheld on Compensation and Final Withholding Taxes

Form: 1604CF

As mentioned, this is for the final withholding tax that needs to be submitted by the employers after the calendar year in which compensation and other earnings were deducted and settled. The deadline is on or before January 31st. If the employee is not subjected to tax deduction; the employer still needs to submit this form with zero as the total.

WITHHOLDING EXPANDED

Monthly Remittance Form of Creditable Income Taxes Withheld (Expanded)

Form: 0619E

This is the type of tax that you need to withhold if you have specific income for your business such as professional fees (for doctors and lawyers) and rental. The deadline is on every 10th day of the month, with the exceptions on March, June, September, and December wherein you need to submit the BIR form 0619F instead for your final withholding tax for each quarter.

Quarterly Remittance Form of Creditable Income Taxes Withheld (Expanded)

Form: 1601EQ

This form is the more detailed version of 0619E, being more specific on the amount that you withheld. You will submit to submit this form on January, April, July, and October.

Annual Information Return of Creditable Income Taxes Withheld (Expanded)

Form: 1604E

This form is needed to be submitted by all employers, regardless if their employees are subjected to any tax or not. The deadline is on or before the 1st of March after the calendar year in which the income was paid.

PERCENTAGE TAX

Quarterly Percentage Tax Return

Form: 2551Q

This is the form you need to submit when you declare 3% from your quarterly gross income receipts. The deadline is within twenty-five (25) days after the end of each taxable quarter (January, April, July, and October).

Quarterly Income Tax

Form: 1702Q

This form is used for corporate Quarterly Declaration or Quarterly Income Tax Return for your NET Income (Revenue – Costs), which is 30% of your taxable income. The deadline for submission is on or before the 60th day following the close of each of the quarters of the taxable year (May, August, and November).

Annual Income Tax Return

Form: 1702RT

The final adjustment return or Annual Income Tax Return must be submitted on or before the 15th day of the fourth month (April) following the close of the taxpayer’s taxable year.

Annual Fee

Form: 0605

Aside from the registration fee, corporations need to settle the Annual Registration fee on or before January 31st.

Procedure (For all Forms mentioned):

For eFPS Filer

- Fill-up applicable fields in the BIR Form.

- Pay electronically by clicking the “Proceed to Payment” button and fill-up the required fields in the “eFPS Payment Form” then click the “Submit” button.

- Receive payment confirmation from eFPS-AABs for successful e-filing and e-payment.

For Non-eFPS Filer

- Fill-up fields in the BIR Form in the downloaded eBIRForm Package and print it in triplicate copies.

- Proceed to the nearest Authorized Agent Bank (AAB) in your RDO where you are registered and present the BIR Form, together with the required attachments and your payment.

- In places where there are no AABs, proceed to the Revenue Collection Officer or duly Authorized City or Municipal Treasurer located within the Revenue District Office where you are registered and present the duly accomplished BIR Form, together with the required attachments and your payment.

For Manual Filer

- Fill-up the BIR Form in triplicate copies.

- Proceed to the Revenue District Office where you are registered and present the duly accomplished BIR Form, together with the required attachments.

- Receive your copy of the duly stamped and validated form from the RDO.

- Manual Filers who want to pay online can pay through GCash Mobile Payment, LandBank of the Philippines (LBP) Linkbiz Portal (for taxpayers who have ATM account with LBP/Bancnet ATM or Debit Card), or DBP Tax Online (for holders of VISA/Master Credit Card/Bancnet ATM or Debit Card).

Final Thoughts:

For a newbie, it may be overwhelming to process all of these BIR Tax deadlines, we suggest hiring a professional who can manage all these for you so you can focus on growing your business. It’s necessary to know the correct forms and the corresponding deadlines because missing or failing to submit one tax type will give you a headache and a loss of money due to penalty.

So, to save you money and for you to focus on growing your business, contact us today and let our consulting expert handles all your taxes.